Energy consumption and industrial ambition toward becoming Net Zero are of global consequence. On the macro scale, as we build more and utilize more digitally and electronically, “the ongoing electrification of everything” makes it imperative to find ways of conserving and managing power consumption.

Integrators and engineers have managed this for some time, born of necessity and innovative thinking. In the last decade, IoT has revolutionized measuring and monitoring the impact of industrial energy consumption and its environmental impact. This involves developing ecological monitoring, renewable energy use cases, HVAC systems for facility management, and IoT energy monitoring systems for better efficiency in utilities and factories.

The Energy Impact and Growth of IoT Development

However, the world’s data demands continue to grow, not least from the massive processing power required by AI / machine learning technologies. UK National Grid CEO John Pettigrew called data centers a source of systemic stress, saying, “Power demands are expected to increase by 500% over the next 10 years.”

A peer-reviewed study in the same report estimates that AI power consumption could reach between 85 and 134 terawatt hours (TWh) annually by 2027. (That is in the range of what Sweden and Argentina each use in a year and would constitute about 0.5% of what the world currently uses.)

AIOTI, an industry alliance tasked with advancing Europe’s digital and green transformations, has identified energy efficiency as one of its 18 strategic research and innovation priorities. The goal is to evolve IoT technologies into an integrated digital ecosystem to advance hyper-automation in all industrial sectors. Specifically, AIOTI identifies three research topics: energy harvesting, with its potential to remove the dependency on batteries for power and their need for periodic replacement; the energy efficiency of hardware, and the energy efficiency of data processing. More on these in our satellite use cases later.

Why is Energy a Design Constraint in Satellite IoT?

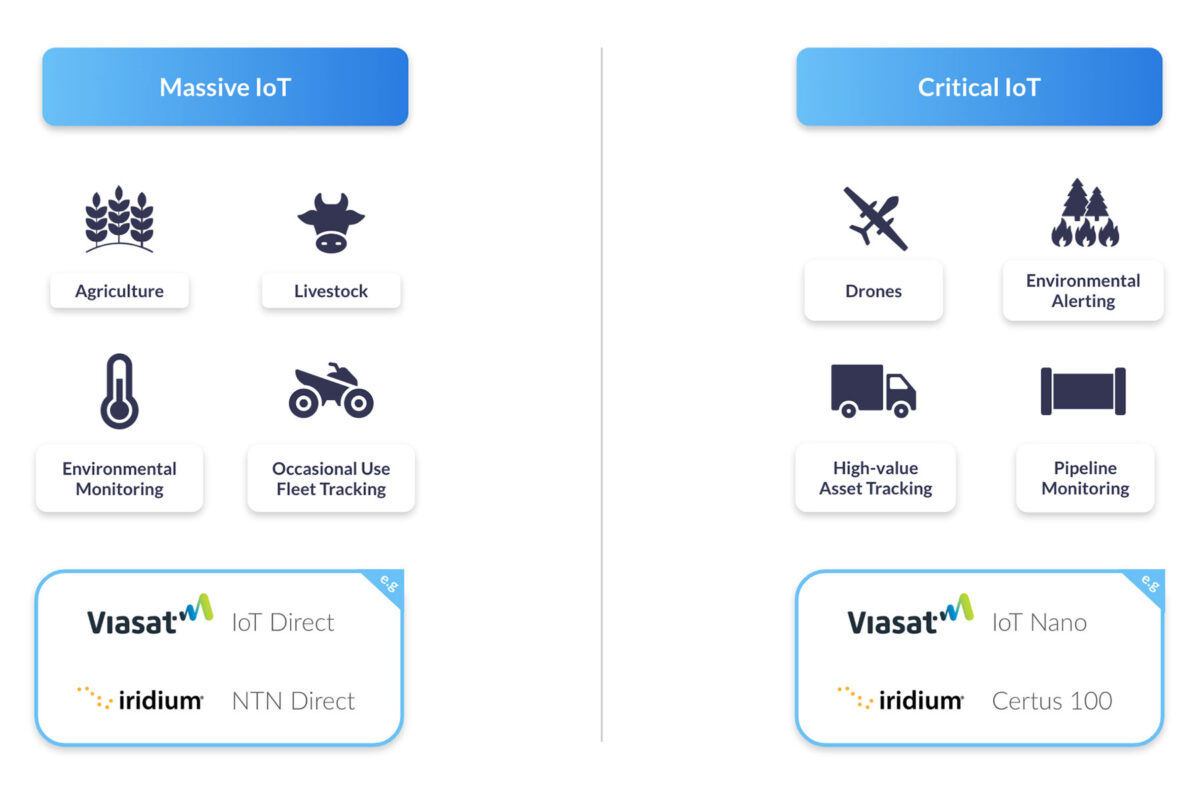

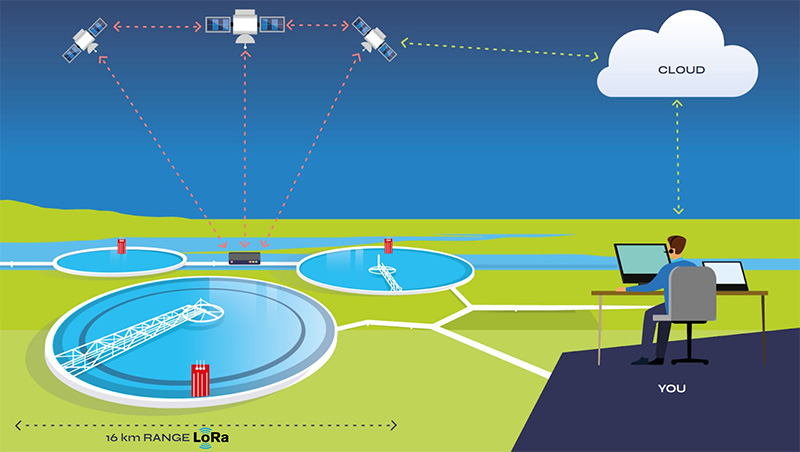

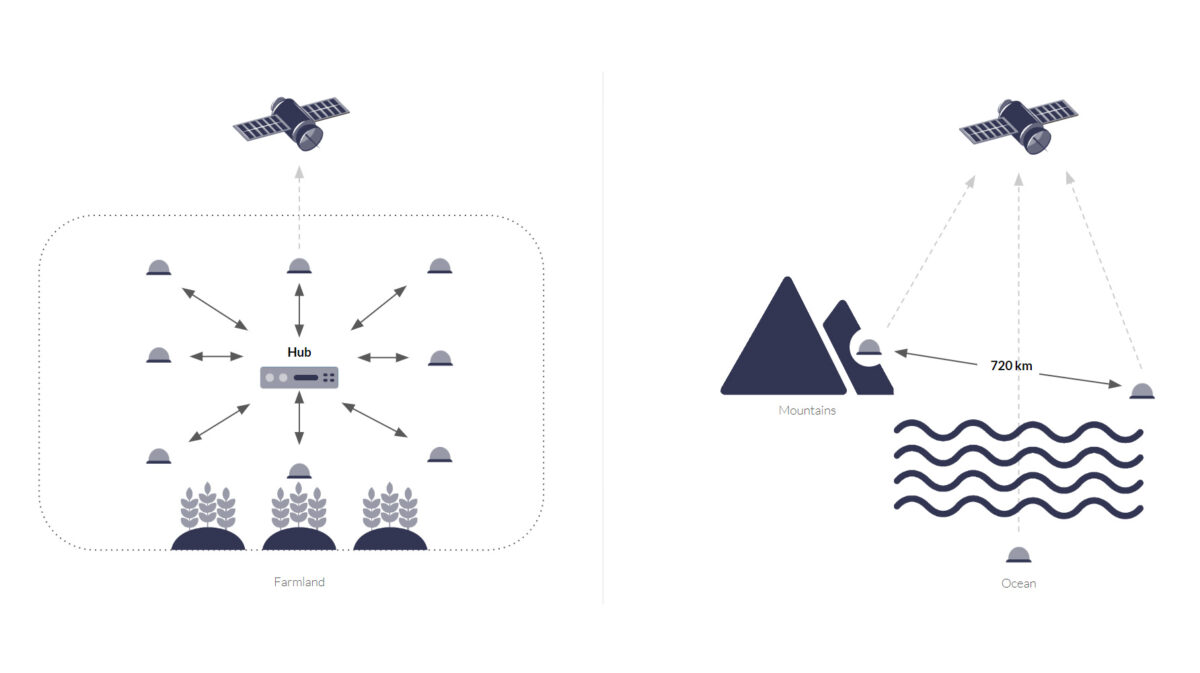

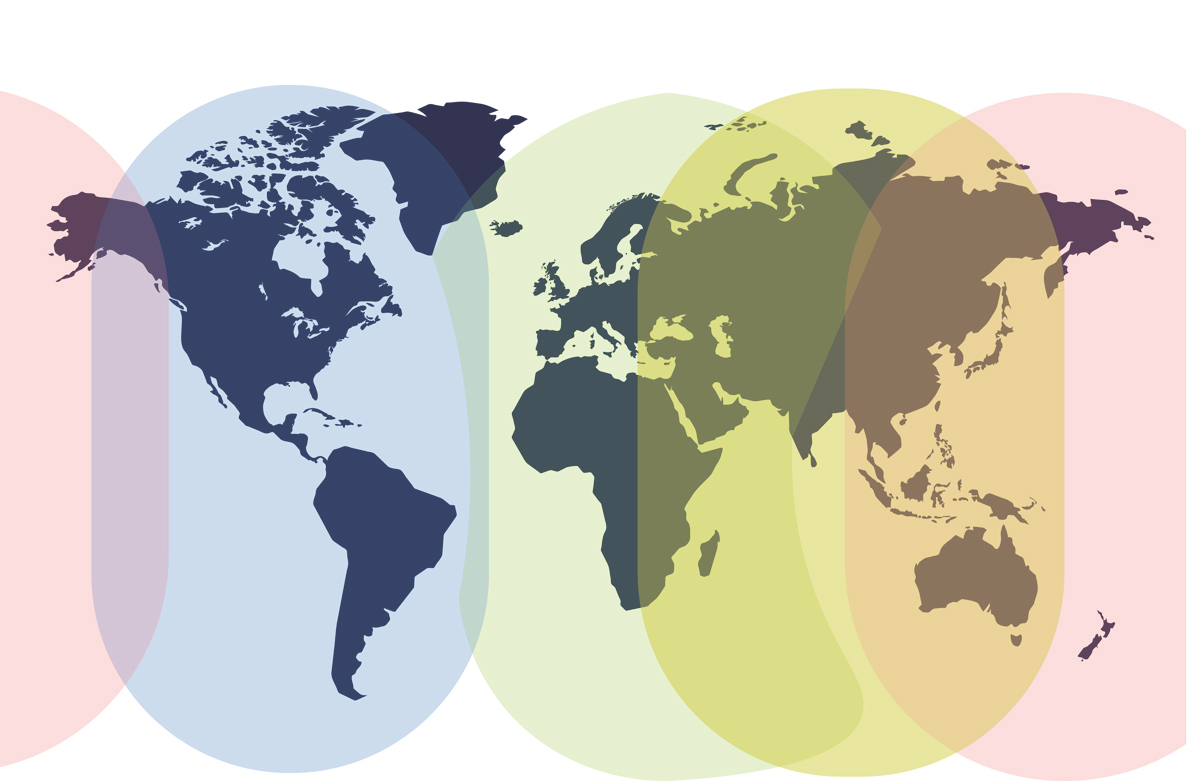

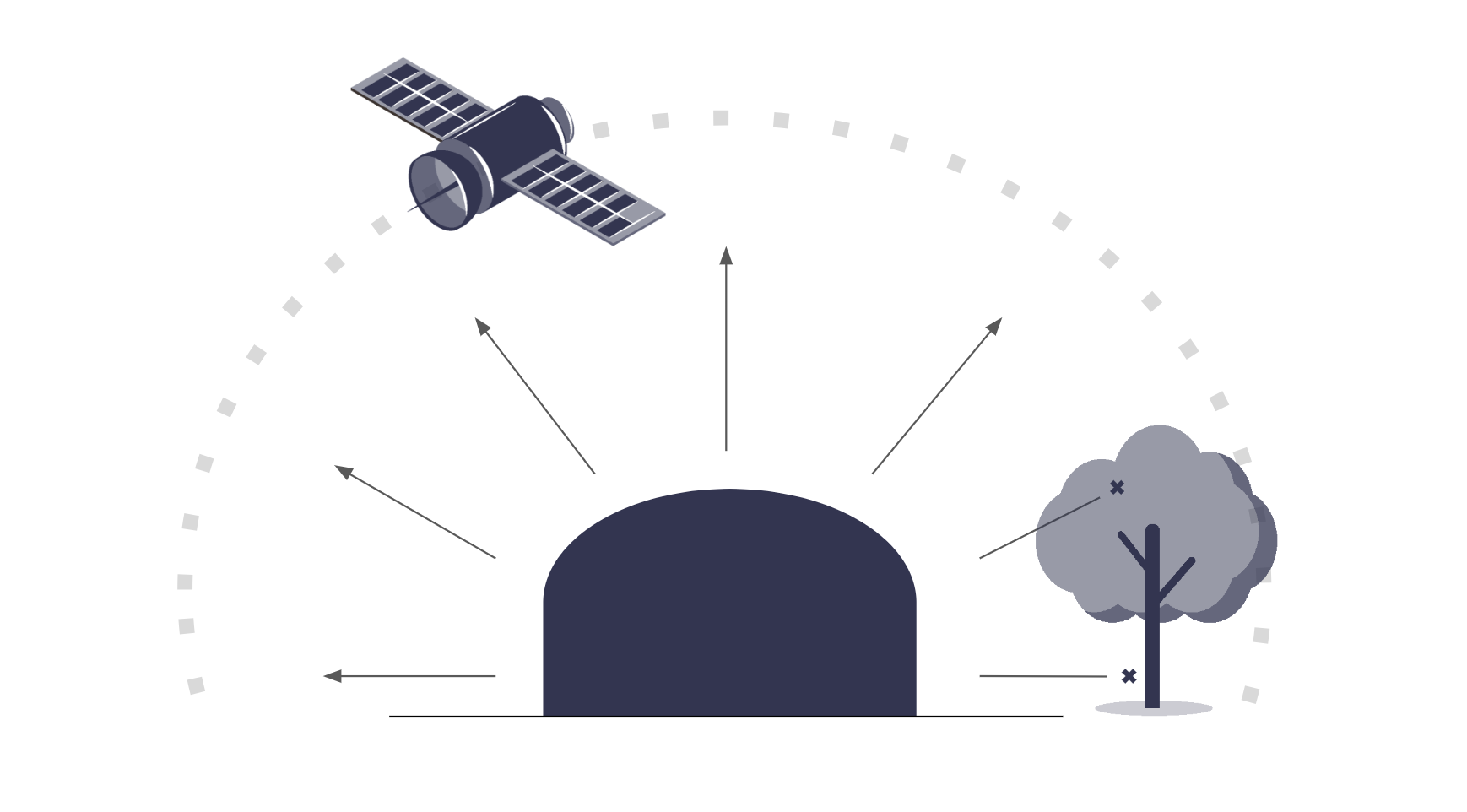

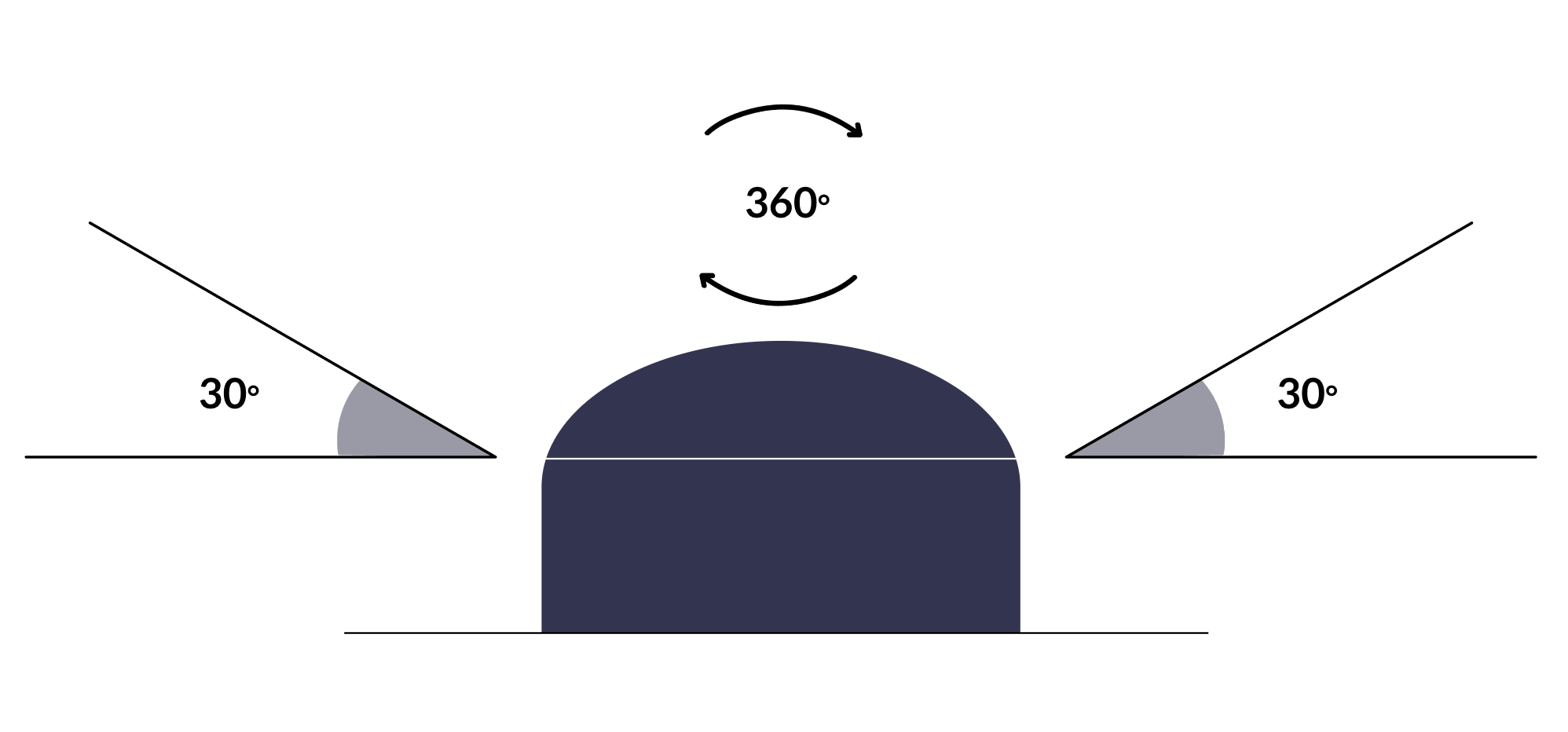

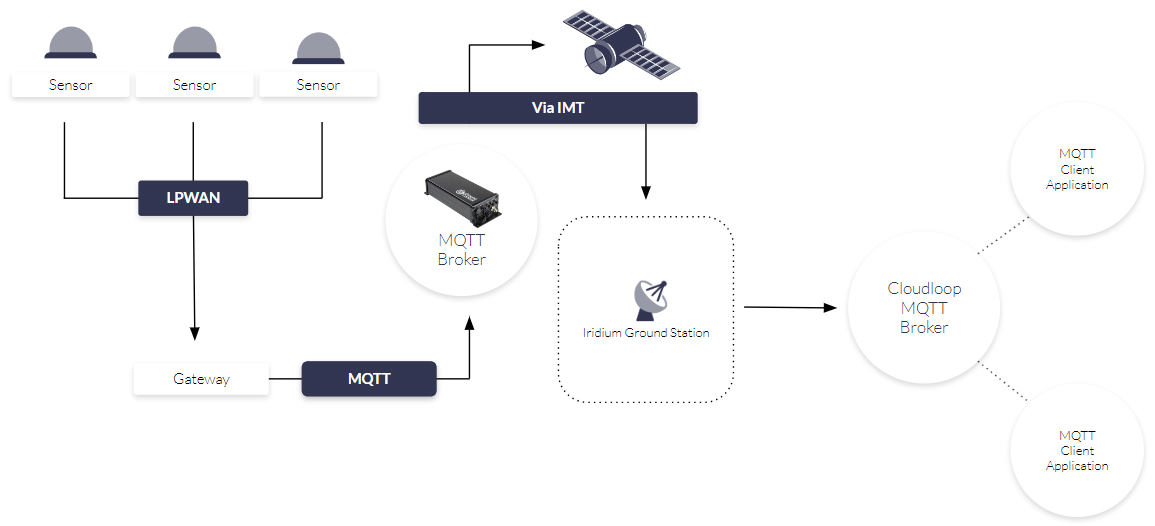

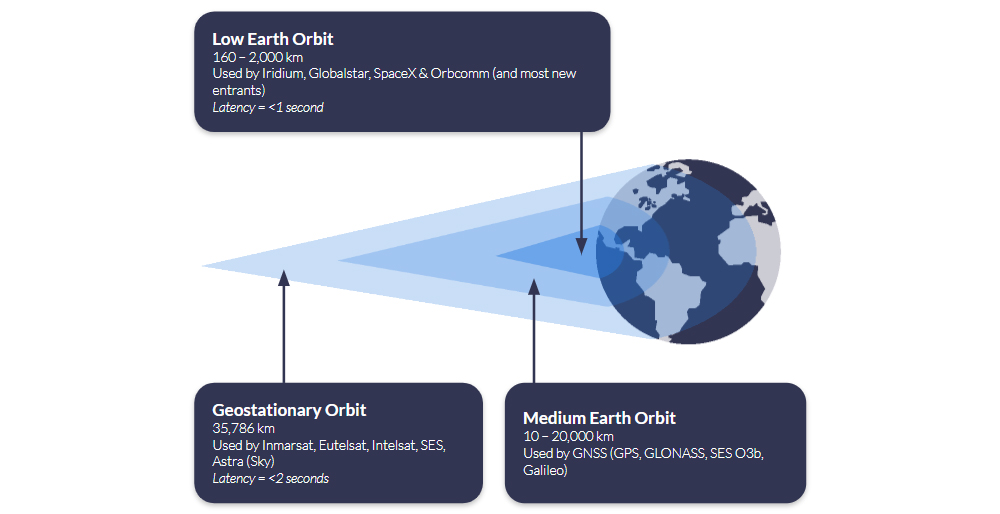

Satellite IoT is a means of transmitting very remote IoT data over satellite. Satellite modems can be paired with individual sensors or can backhaul the data from LPWAN gateways. Power usage is often a constraint within these types of IoT applications because mains power is frequently unavailable. Therefore, it matters that the system’s energy consumption and a ‘Low Power Mindset’ are part of the IoT system design process.

Five Power Conservation Examples in Remote Satellite IoT

Here, we explore five design considerations in Satellite IoT that have helped remotely manage IoT energy consumption. Utilizing what energy is available, making it go further, and where possible, reducing the industrial carbon footprint.

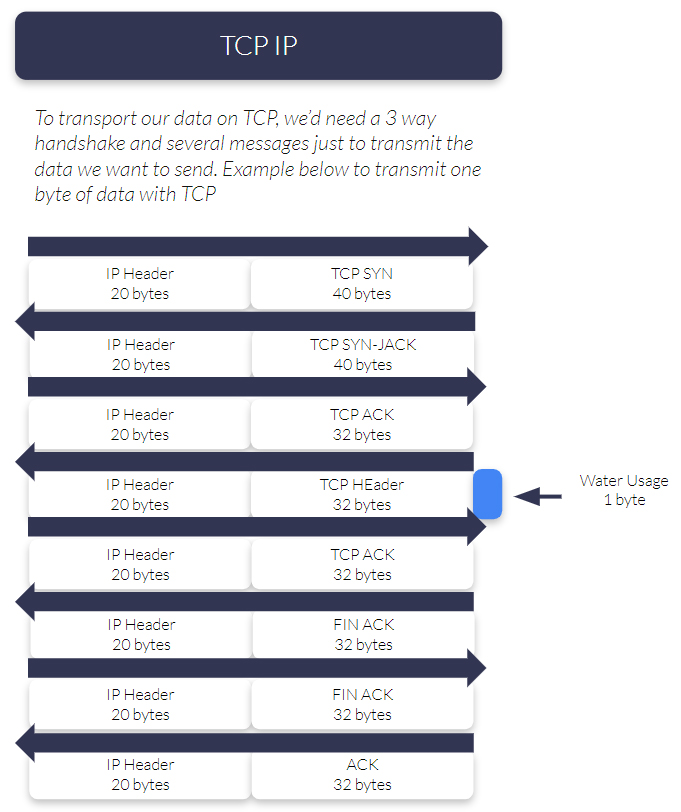

1. Minimize What Data You Send, and how Frequently You Send it

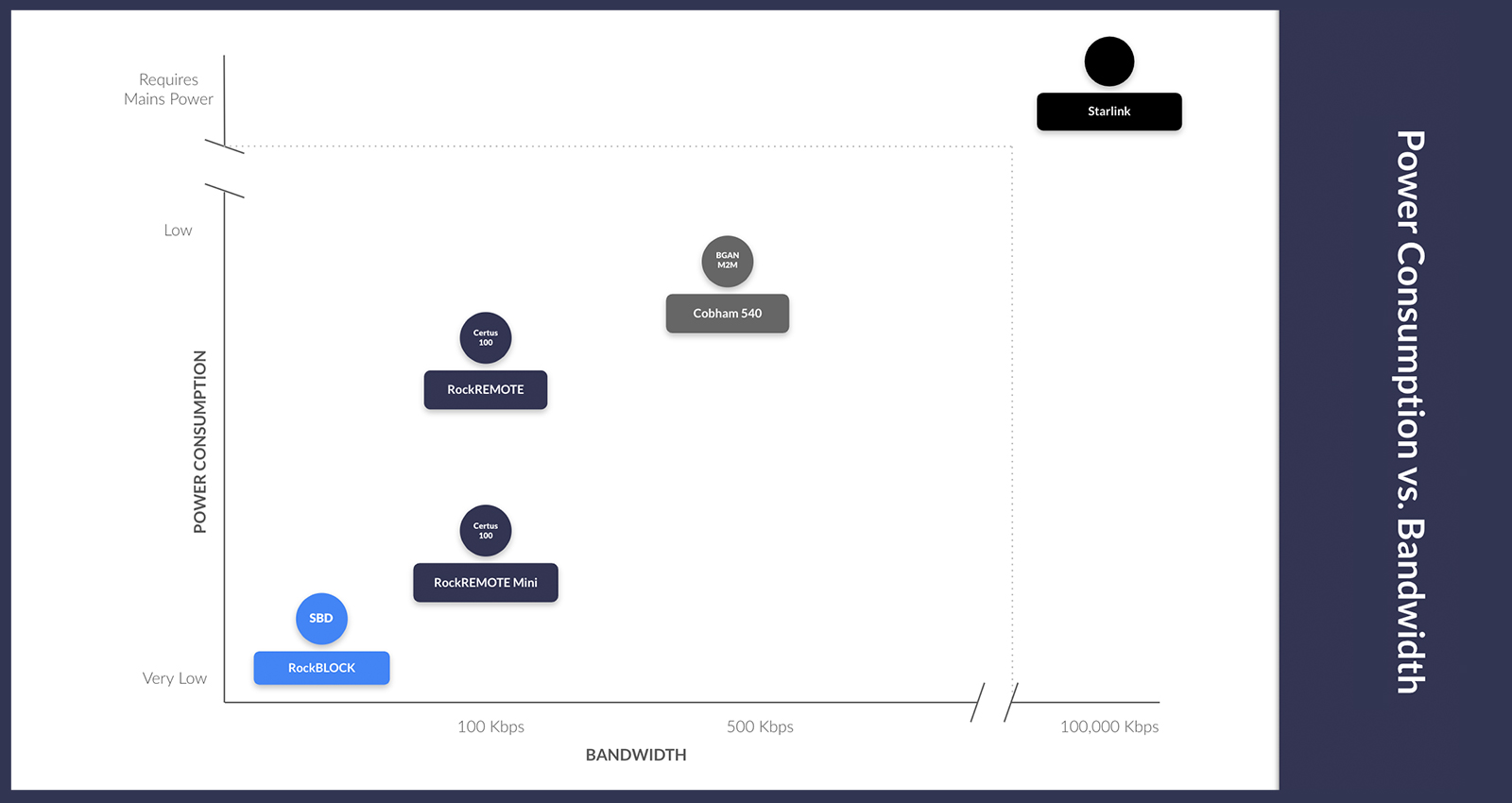

Low power design considerations were recently explored in our webinar for IoT Central, covering Data Optimization, Interoperability, Coverage and Power Consumption in Satellite IoT design. Deep-diving into the section on power, the more data bandwidth a satellite IoT system utilizes, and the more frequently it sends data, the more power-hungry the satellite IoT device will be.

A key takeaway from the discussion: since both the send and idle mode for the device consume energy, keeping the device send mode to a minimum and utilizing a satellite device with low resting energy consumption in idle, are important considerations. This video snippet discusses the key design considerations for preserving power in Satellite IoT design. For a longer summary of the webinar, you might enjoy our post: A Guide to Satellite IoT for Cellular IoT Specialists

2. Data Processing at the Edge

Every time data is sent over a network, there is some level of energy cost in terms of power used; this is no exception with satellite networks. Satellite IoT connectivity requires more power than terrestrial networks to establish and maintain communication links with satellites in space. Edge computing utilizes light algorithms and task offloading to execute intensive tasks at the network’s edge. It can conserve energy on satellite IoT devices, make smart task decisions, decrease task delay, and reduce the volume of data sent over the network.

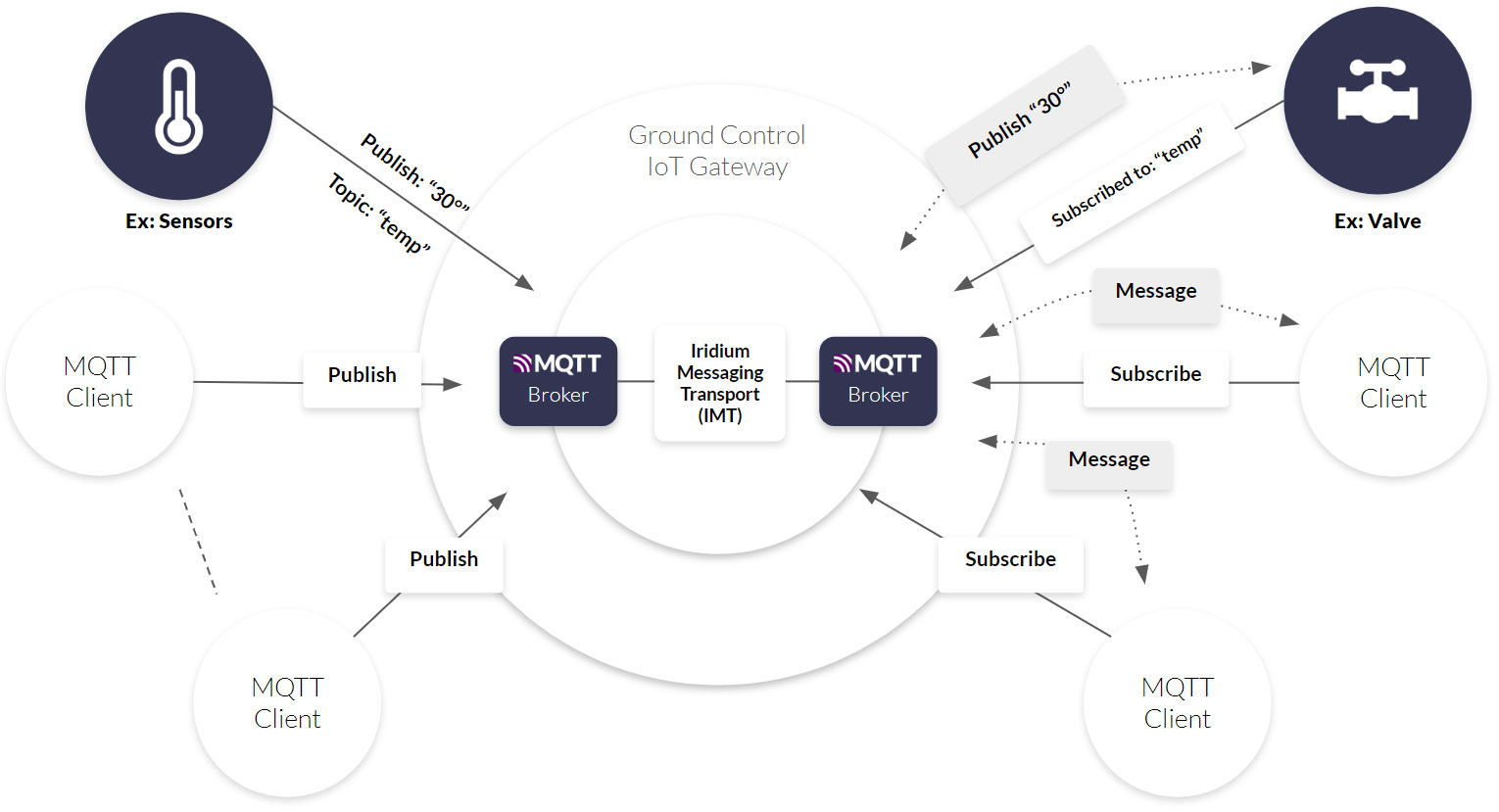

RockREMOTE’S edge computing capabilities have helped reduce system energy by analyzing data at the data collection point. Its capabilities include reporting by exception, defining data prioritization, and the ability to compress the data at the edge before sending it over the satellite network. With LTE-M, Certus 100, and IMT capabilities, the device switches between networks for uninterrupted connectivity. This provides 100% connectivity, balancing data transfer costs, appropriate network selection, and minimizing network energy consumption. This short video talks more about RockREMOTE’s edge processing capabilities in a use case on African Game Reserves.

3. Energy Harvesting – Solar Energy for Satellite IoT Sustainability

Energy harvesting can provide an inexhaustible electrical energy supply captured from renewable sources: solar, wind, hydroelectric, biomass, tidal, and wave energy. Depending on the application and the supply, this energy can supplement or replace a primary cell or battery. Harvested energy can be used to power the circuitry directly or stored in the buffer until needed.

A recent use case for RockBLOCK RTU involved a customer measuring water levels in fracking sites in northern Canada. The localities were remote, unmanned, and unpowered, and temperatures frequently dropped below -32°C (-25.6°F). The solution needed to be self-powered, extremely robust, and reliable. The RockBLOCK RTU satellite transceiver is highly ruggedized to cope with harsh weather conditions and has very low power requirements. Accordingly, it consumes less than 380mW with a five-minute value transmission interval. Connecting it to a small solar panel array, combined with a lithium-based cell, harvested more than enough solar power to send two daily messages over satellite, plus an immediate alert if water levels exceeded predefined parameters.

4. Power and Cabling Efficiencies with Power over Ethernet (PoE)

Piggybacking off existing power supply with PoE eliminates the need for a separate power supply by delivering DC power to a device from the existing Ethernet infrastructure. Strictly speaking, this example means that the power cabling already exists, and a power supply for other technology is available to share. Think offshore platforms, ships, or buoys to bring to life some, (not all) examples of this use case: some power, but with limited cellular connectivity. Utilizing PoE to supply the satellite device reduces standby power consumption and overall energy usage.

A centralized power management approach can also enable more efficient resource allocation and reduce energy waste compared to individual power adapters for each connected device. PoE standards, such as IEEE 802.3af and IEEE 802.3at, include power-saving mechanisms like sleep modes and low-power states. This enables connected devices to operate more efficiently and intelligently, managing power consumption based on usage patterns leading to overall energy savings.

The pictured RockREMOTE Mini keeps satellite device power consumption very low, with less than 0.25W in receive mode. In addition to its optimized power consumption, it has two power supply options: a 10-30V supply or PoE+ (802.3at). This flexibility provides a convenient and efficient solution for powering the device and eliminates the need for a separate power source, reducing installation cost and design complexity.

5. Pulse Width Modulation in Remote Locations

Pulse Width Modulation (PWM) is a technique for controlling the amount of power delivered to an electronic device by rapidly switching the power on and off. The key to PWM is controlling the duty cycle, which is the percentage of time the signal is “on” versus the time it is “off” during each cycle.

Imagine a light dimmer that can adjust the brightness of a light. Instead of providing a steady flow of electricity, the dimmer rapidly switches the light on and off. The average brightness of the light depends on the proportion of the time it is on versus the time it is off:

High Duty Cycle: If the light is on 90% of the time and off 10% of the time, it will be very bright.

Low Duty Cycle: If the light is on 10% of the time and off 90% of the time, it will be dim.

PWM works similarly with other devices, like motors, where it controls speed, or heaters, where it controls temperature.

In the vast, sparsely populated Australian Outback, isolated and off-grid locations such as cattle stations and small farms require satellite technology to manage solar power systems for water pumps, electric fences, and communications equipment, ensuring continuous operation. Ensuring the battery life of the equipment is essential to keeping everything in operation and managing energy usage efficiency.

The RockBLOCK RTU’s PWM controls the battery charging current from connected solar panels. By adjusting the duty cycle, the charge controller regulates the voltage and current, preventing overcharging and optimizing battery life. The RockBLOCK RTU Micrologger device is designed to operate with minimal power, which is crucial for keeping the remote installations running without over-drawing energy from the overall system. Triggering on/off switching can be key to managing resources, conserving, and managing the power supply, and extending battery lifetime in remote and/or unmanned locations.

With power supply and energy management as consistent considerations in developing satellite IoT projects, these use cases highlight the variety of innovations that have been used to navigate the physical, logistical, and infrastructure limitations of remote off-grid locations. Once the parameters of the Satellite IoT project are established, often the most appropriate solution is obvious. Our engineers love a challenge, so if there is an energy constraint holding your remote IoT project back, get in touch, and our technical and development teams will be happy to help.

Would you like to know more?

If you’re tackling an remote connectivity challenge, with constraints on power, we can almost certainly help.

Call us on +44 (0) 1452 751940 (UK) or +1.805.783.4600 (USA); email hello@groundcontrol.com, or complete the form.

We have over 20 years’ experience designing and building satellite communication devices, and our expert team is standing by to offer support and suggestions.