Standards-based satellite IoT is finally usable for real workloads, but only if you understand where it works today, what it costs, and how to design for its constraints.

Our new eBook, Decoding NTN: The Reality Behind Standards-Based Satellite IoT, sets out a pragmatic view of NTN for IoT teams planning 2026 – 27 deployments.

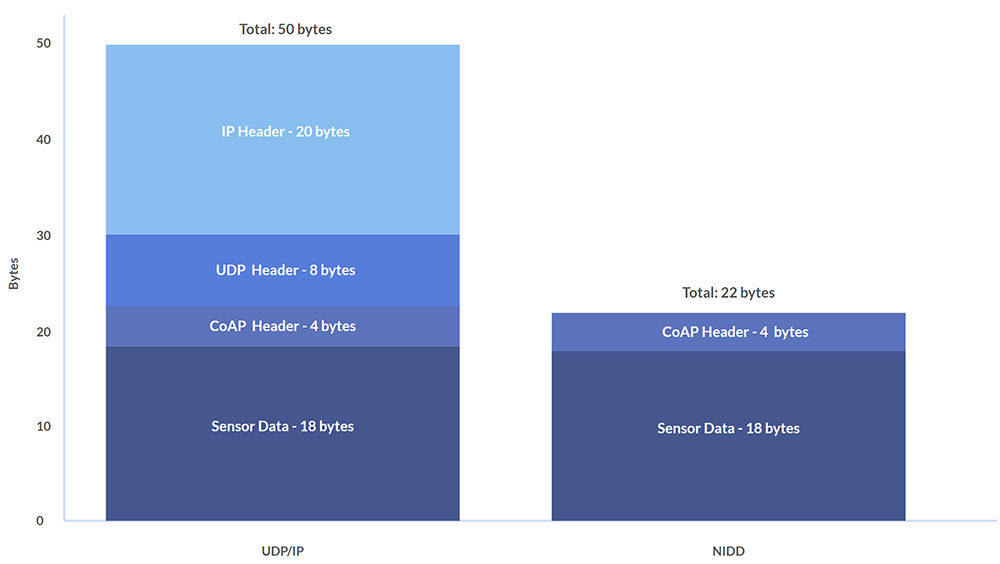

Inside, we translate standards-speak into decisions you can act on: when NB-IoT vs LTE Cat-1 over satellite makes sense, how minimum session size and protocol overhead (NIDD vs UDP/IP) shape data budgets, and what today’s coverage and SCS approvals mean for rollout planning. You’ll get a plain English decision matrix and realistic timelines so you can deploy with confidence rather than hype.

What's Inside

Why This eBook, Now

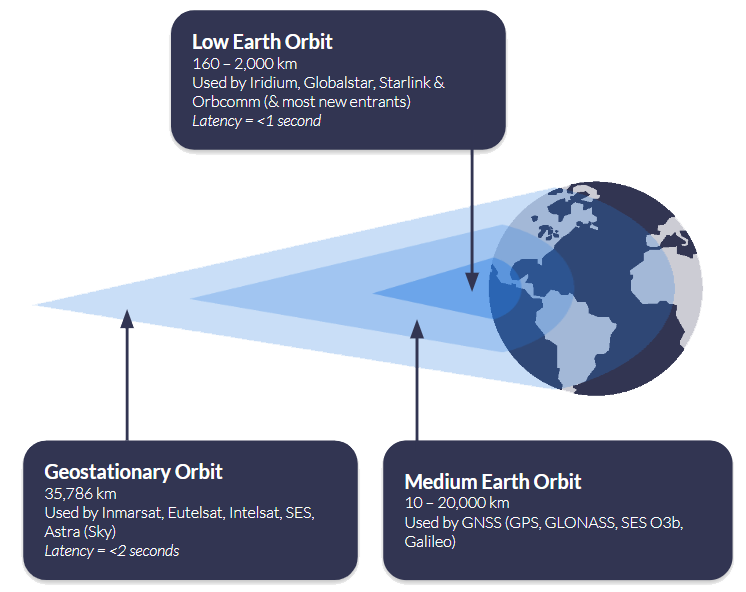

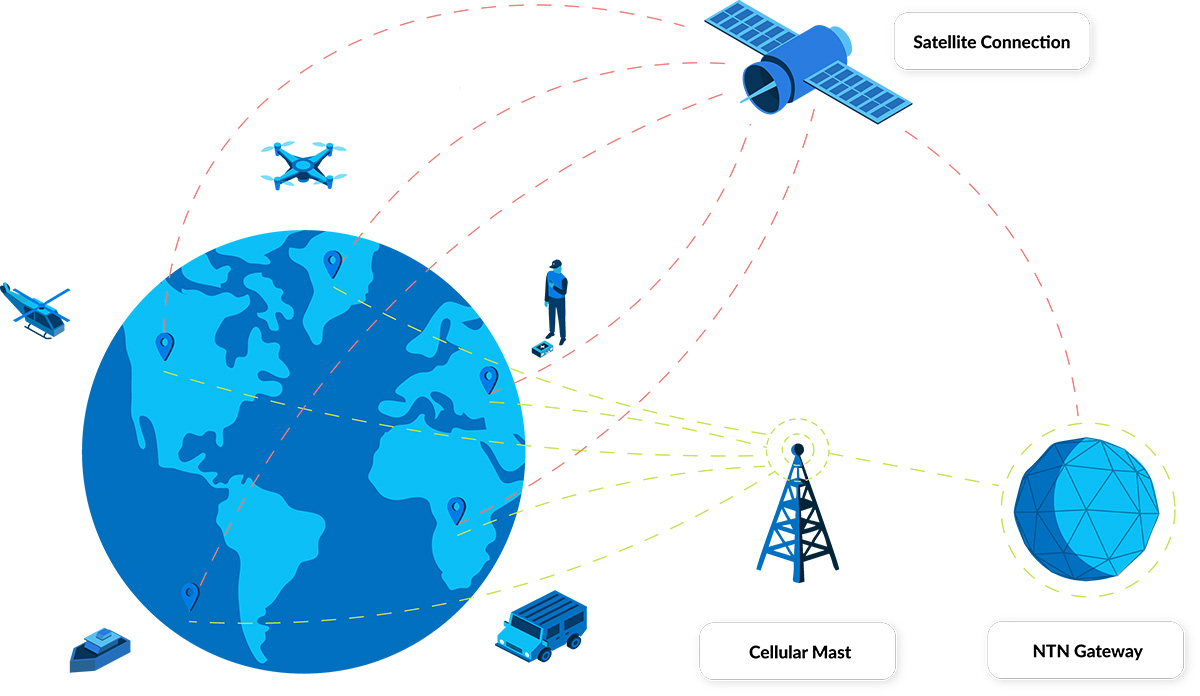

There’s been no shortage of headlines about direct to device (D2D) and “everywhere coverage”, yet many claims blend marketing terms with evolving standards. In practice, NTN means running existing cellular standards – NB-IoT or LTE – over a satellite link. That shift promises simpler hardware and a shared device ecosystem, but it also introduces satellite-specific realities: higher/variable latency, small cost-optimized data volumes, line of sight requirements and country by country enablement.

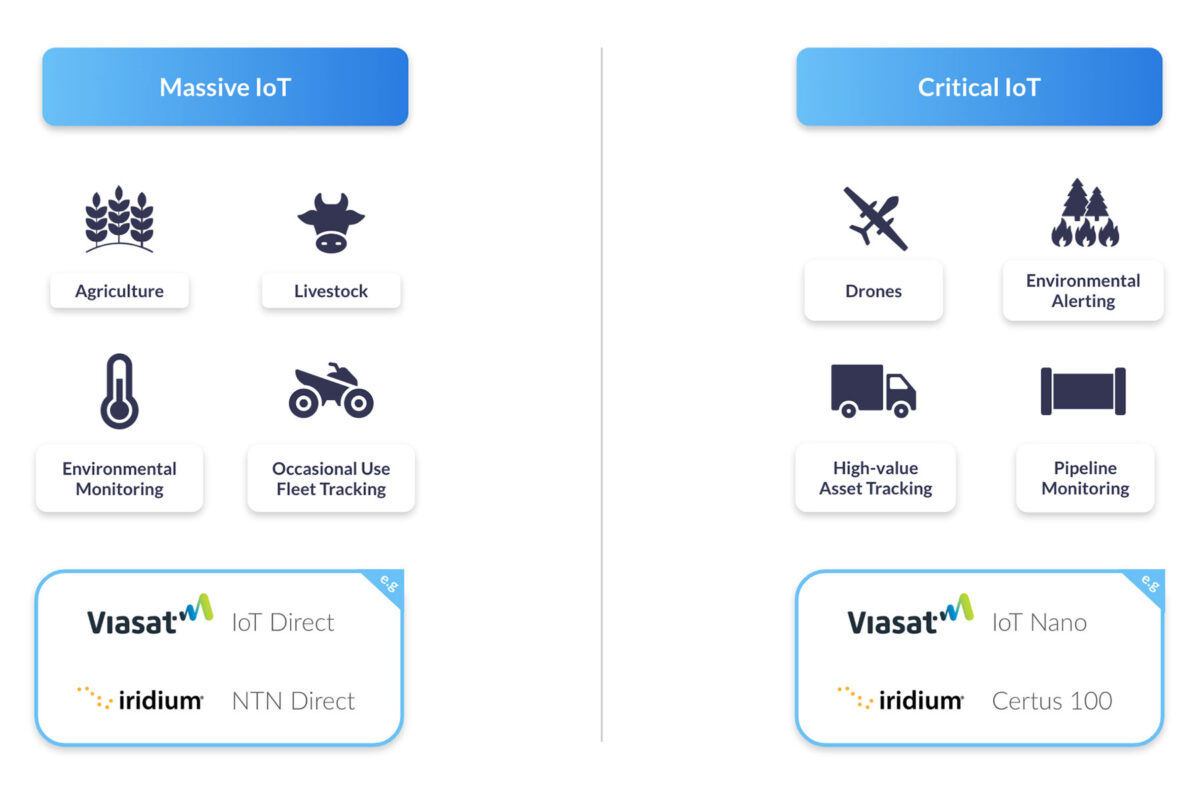

Our goal with this eBook is to separate signal from noise. We focus on what works now with NTN NB-IoT, what’s likely next with LTE Cat-1 over satellite, and when a proprietary service remains the right answer.

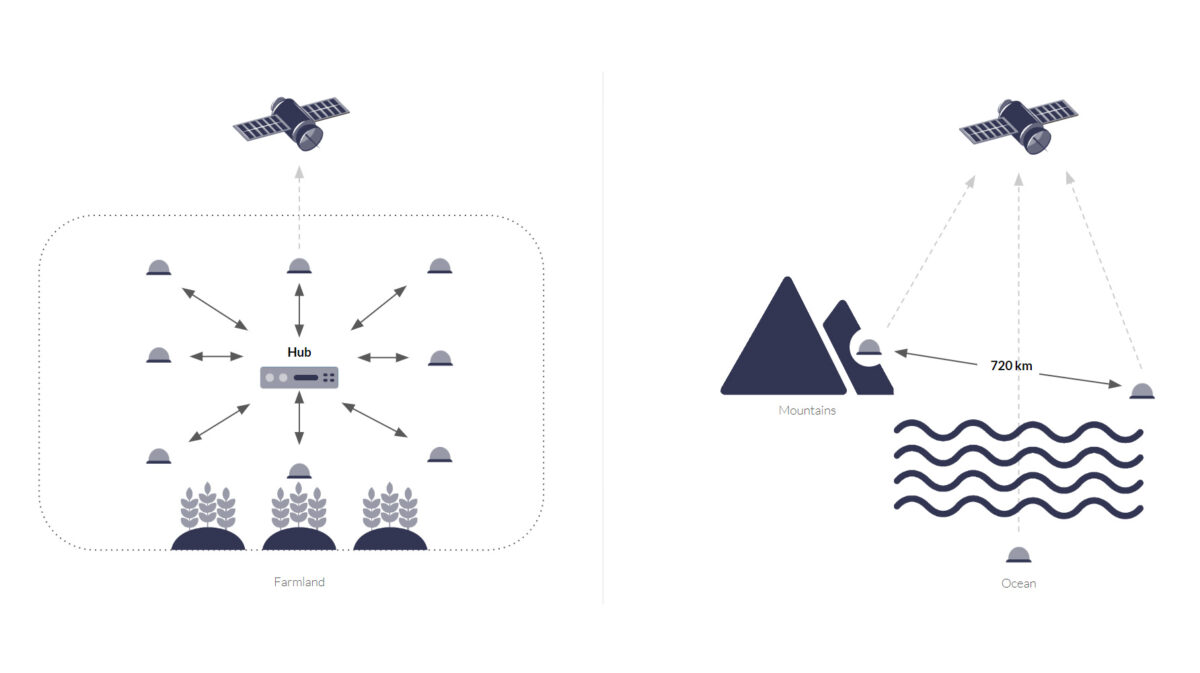

Coverage Today: Useful, Not Universal

The phrase “global coverage” is seductive. The reality is more localised. Current NTN availability concentrates in specific regions (with notable gaps over oceans and in many countries), and depends on national approvals often referred to as Supplemental Coverage from Space (SCS). In other words, you switch service on country by country, which means deployment plans should be validated market by market. The eBook explains how to assess coverage for your intended regions, including practical placement advice for your antenna.

Payloads and Minimum Session Size: Every Byte Counts

If you’re coming from terrestrial NB‑IoT, airtime budgeting over satellite is different. The cost optimized range for NB‑NTN is small (tens of kilobytes per device per month), and protocol choice has an outsized impact. Non‑IP Data Delivery (NIDD) keeps overheads lean for micro‑telemetry; UDP/IP is often simpler to integrate but adds bytes you’ll pay for. Some providers impose a minimum session size that can negate NIDD’s benefits for very small payloads. The eBook includes concrete examples of payload budgeting and shows when NIDD becomes attractive as commercial offers evolve.

Reliability by Design

Satellite introduces distance and scheduling. Expect higher/variable latency than cellular, and design sensible send cadences if you want predictable costs and battery life. If your use case needs near‑real time interaction or frequent updates, a proprietary IP service is usually the right tool; if you’re moving small, delay‑tolerant telemetry a few times a day, NTN services can be an excellent fit.

NB‑IoT vs LTE Cat‑1 Over Satellite

NTN is an umbrella that covers both NB‑IoT and LTE Cat‑1 waveforms. They serve different jobs. NB‑IoT over satellite fits tiny, infrequent messages on multi‑year batteries. LTE Cat‑1 over satellite suits lighter, less time critical IoT sessions where you may need occasional configuration changes or small bursts of data, typically with external power or larger batteries. The eBook includes a decision matrix to help you map each device profile to the right path.

Timelines You Can Plan Against

We outline what’s available now, what’s expected in 2026 (including anticipated support that may improve minimum session sizes), and how the broader ecosystem is likely to ramp into 2027. We also provide a sober view on “ubiquity”: harmonised experiences across orbits and architectures will take time, and national approvals will continue to shape availability.

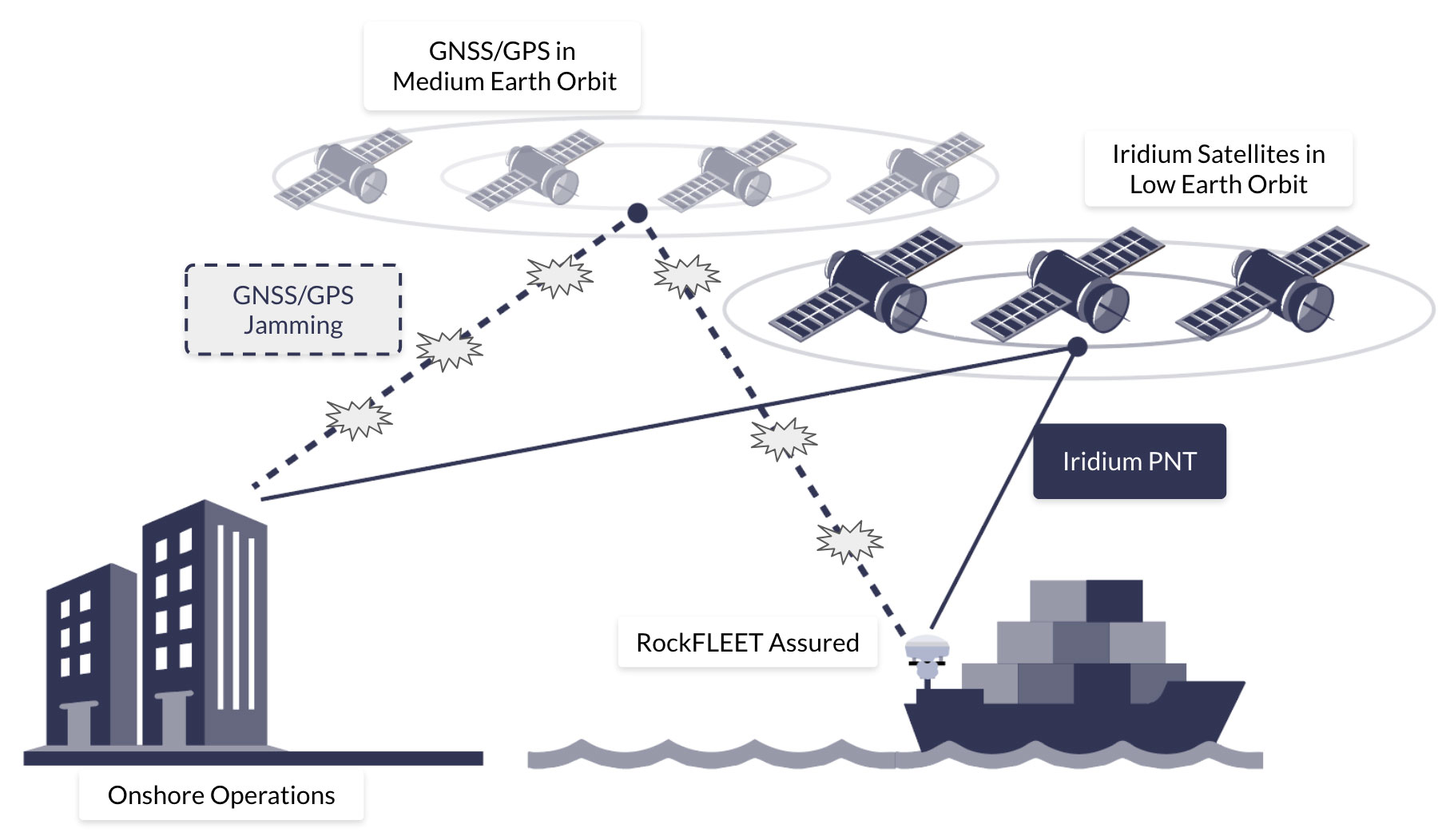

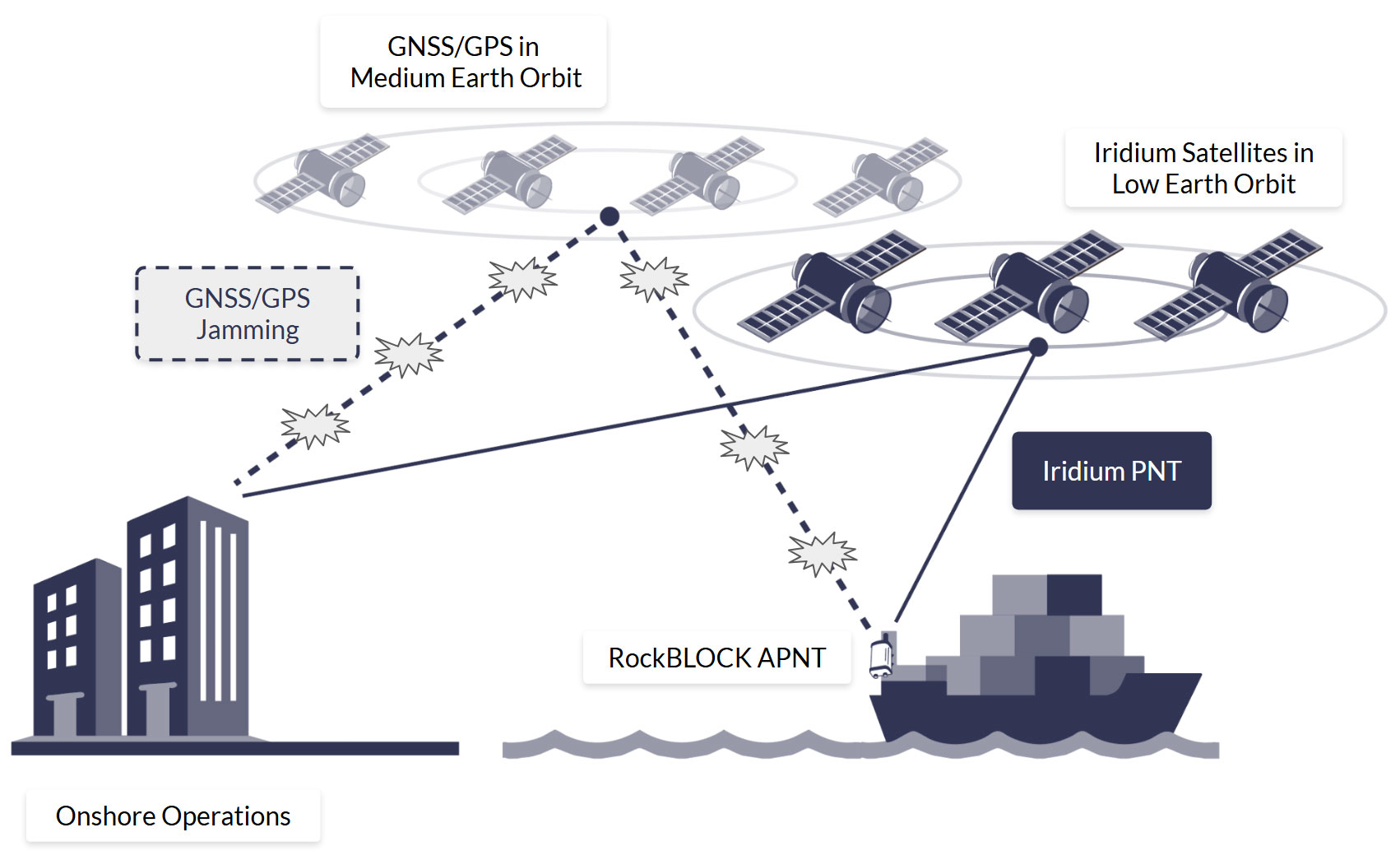

When Proprietary Services are Still the Better Choice

If your application needs interactive, two way IP sessions, predictable low latency, or larger payloads, proprietary services remain the workhorses. The eBook compares message‑based proprietary options (efficient for small bursts) with IP‑based services (best for control loops, richer telemetry or firmware deltas), so you can decide on merit rather than ideology.

Get the Full eBook

If your devices operate beyond terrestrial coverage, this eBook gives you the practical guidance to de-risk deployments: how to validate coverage market by market, budget payloads with minimum session size in mind, and decide when NB-IoT or LTE Cat-1 over satellite (or proprietary alternatives) will best serve your requirements.

You’ll find vendor-agnostic explanations, real world constraints stated plainly (line of sight, latency, approvals), operator perspectives from recent panels, and a simple decision matrix you can adapt into your specification. It’s written for product, firmware and operations teams who want clear, testable criteria – not hype.

Talk to our Team

If you’d like to talk to the Ground Control team about your remote IOT application, please email hello@groundcontrol.com or complete the form. We have over 20 years of experience in delivering satellite connectivity, and work with major satellite network operators including Iridium, Viasat, OneWeb and Starlink.

Note: You don’t need to complete the form to get the eBook; just click on one of the links, it is an ungated resource.