The Internet of Things (IoT) market is set to grow globally by 18.8% over the next five years, fueled by advancements in 5G and AI technologies, rising demand for automation, and the expanding application of IoT across various industries.

For IoT applications in remote areas beyond the reach of 5G cellular towers, such as environmental monitoring and asset tracking in isolated regions, mountainous terrains, open oceans, and across multiple borders, continuous connectivity remains a challenge. In these scenarios, businesses often turn to satellite IoT, but the perceived high cost and apparent lack of interoperability with terrestrial networking technology may present barriers.

Direct-to-Device (D2D) technology is emerging as a transformative solution to these challenges, poised to revolutionize the IoT marketplace. But before we get to that, let’s clarify what’s meant by the various “direct-to-cell, direct-to-device, direct-to-mobile” terms being bandied about.

What is Direct-to-Cell?

Direct-to-Cell (D2C) is a form of satellite connectivity that enables smartphone users to perform basic functions like texting, calling and basic internet browsing when outside of cellular coverage, with no modifications needed to their cell phone.

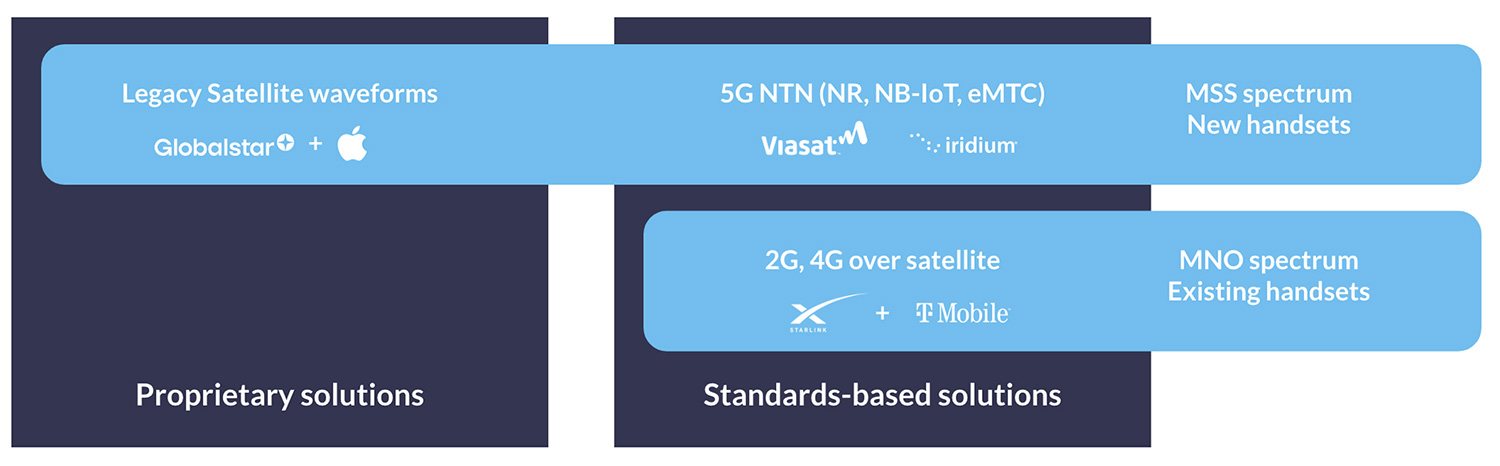

This service can be provided in one of two ways: firstly, the satellite network operator (SNO) may partner with a mobile network operator (MNO), and provide the service using the MNO’s licensed terrestrial radio frequencies. In order to do this, both the SNO and the MNO need to use the same waveform technology, e.g. 4G/LTE. This requires the satellites to be designed and deployed with this capability; effectively, it is the satellite that is modified to work with the device, rather than the device being modified to work with the satellite. An example of this is Starlink’s partnership with T-Mobile in the USA.

Secondly, cell phone manufacturers can update their devices to allow them to talk to satellite constellations. This can either be delivered through proprietary solutions – i.e. the handset is updated to allow it to ‘talk’ to a single satellite constellation only (for example, Globalstar’s partnership with Apple) – or via a standards-based solution which can talk to multiple compatible networks, i.e. 5G NTN (NR, NB-IoT, eMTC).

In the case of the latter – where the necessary adjustments are made on the cell phone rather than the satellite – there are a limited number of smartphones that have been made compatible with 5G NTN, including the Google Pixel 9; we’d expect to see this increase in the future.

Image credit: Peter Kibutu, Advanced 5G NTN Technology Lead, TTP

What is Direct-to-Device?

Direct-to-Device (D2D) enables unmodified IoT devices, such as asset tracking beacons and temperature sensors, to transmit data over satellite when cellular is not available. This means that no extra hardware or software is needed to deploy a sensor outside of cellular coverage, or to monitor an asset moving in and out of cellular connectivity.

The difference between Direct-to-Cell and Direct-to-Device is simply the device being connected; in the case of the former it refers to cell phones; in the case of the latter, to IoT devices. They are often used interchangeably – Starlink, for example, refers to both phone and IoT device connectivity as Direct to Cell, whereas analysts Deloitte refer to both as Direct to Device.

For the purposes of this post, we’ll be focusing on IoT applications, and will stick to ‘Direct to Device’.

How Does D2D Work?

Similarly to D2C, there are two ways to deliver D2D. The first is to launch new satellites specifically designed to talk to existing IoT devices, and the second is to add an inexpensive chip to IoT devices so that they can talk to existing satellite networks. This could either be a proprietary chip, which allows the device to speak to a single satellite network, or a standards-based chip, which, in theory, would allow the device to roam on to any network built to the same standards.

There are pros and cons to each approach; in the case of purpose-built satellites, the main plus is that there is a large market of existing devices. However, as we will see, there are performance, spectrum, funding and regulatory challenges to overcome. In the case of new chipsets, whether standards-based or proprietary, it will take time for these to be developed and deployed at scale.

“What technical approach will predominate—one where chipsets in smartphones power satellite communication or where satellites act more as space-based cell towers enabled by network-on-the-edge architecture? In either case, advancement in both satellite and smartphone technology will likely be necessary to enable the full potential of D2D.” – Deloitte Center for Technology, Media & Telecommunications

What Role do Standards-Based Technologies Have to Play in D2D?

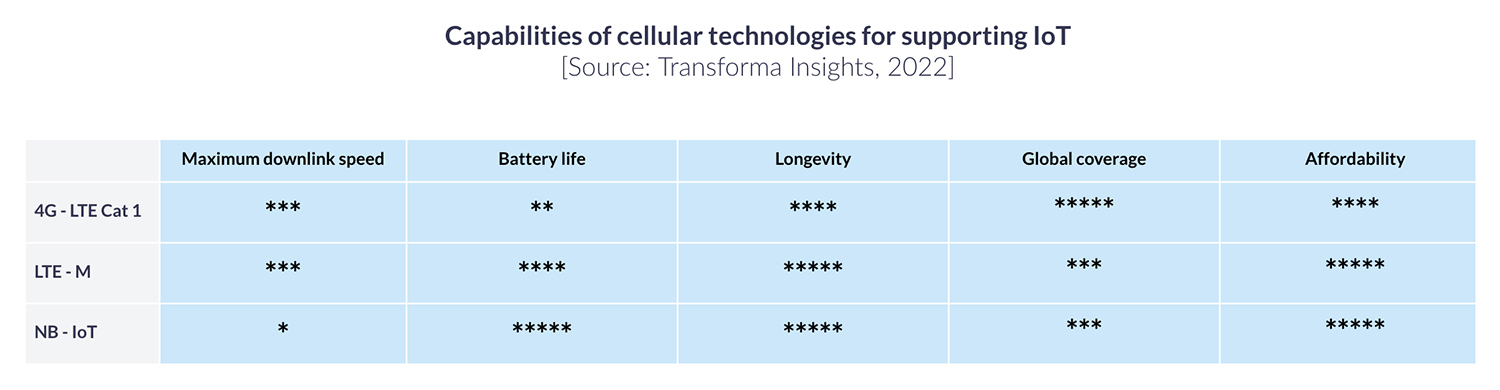

There are three cellular-based technologies designed for widespread IoT devices: NB-IoT, LTE-M, and LTE Cat 1. There are lots of blog posts dedicated to the pros and cons of each technology; as a very quick summary, NB-IoT and LTE-M use less power than LTE Cat 1, but LTE Cat 1 has higher data rates and lower latency.

LTE Cat 1 is available wherever there is a 4G LTE network; which covers most of the Earth’s population centers. LTE-M and NB-IoT network technologies are less widely available; 253 mobile network operators have launched NB-IoT or LTE-M networks in 81 countries, of which 173 operators have focused on NB-IoT, and 80 have focused on LTE-M (source).

The satellite network operators working on the delivery of D2D have not all chosen the same cellular technology. Starlink, AST Space Mobile and Lynk have all selected LTE Cat 1, whereas Iridium and Viasat have chosen NB-IoT.

This is probably because the more power-hungry LTE Cat 1 technology would create too great a resource drain on legacy satellite constellations which were not built for high volumes of high speed internet traffic. Equally, where there is no cellular infrastructure, there is often no power source, so an NB-IoT device that can last for years on a single battery is an appealing proposition.

Ultimately, systems integrators will need to make an informed decision about the most suitable technology for their requirements, based on service availability, data volume, latency, and power supply; this will then determine on to which networks their devices can roam.

Who are the Satellite Operators in the Direct-to-Device Market?

LTE Services:

NTN NB-IoT Services:

Challenges in Rolling out Direct-to-Device

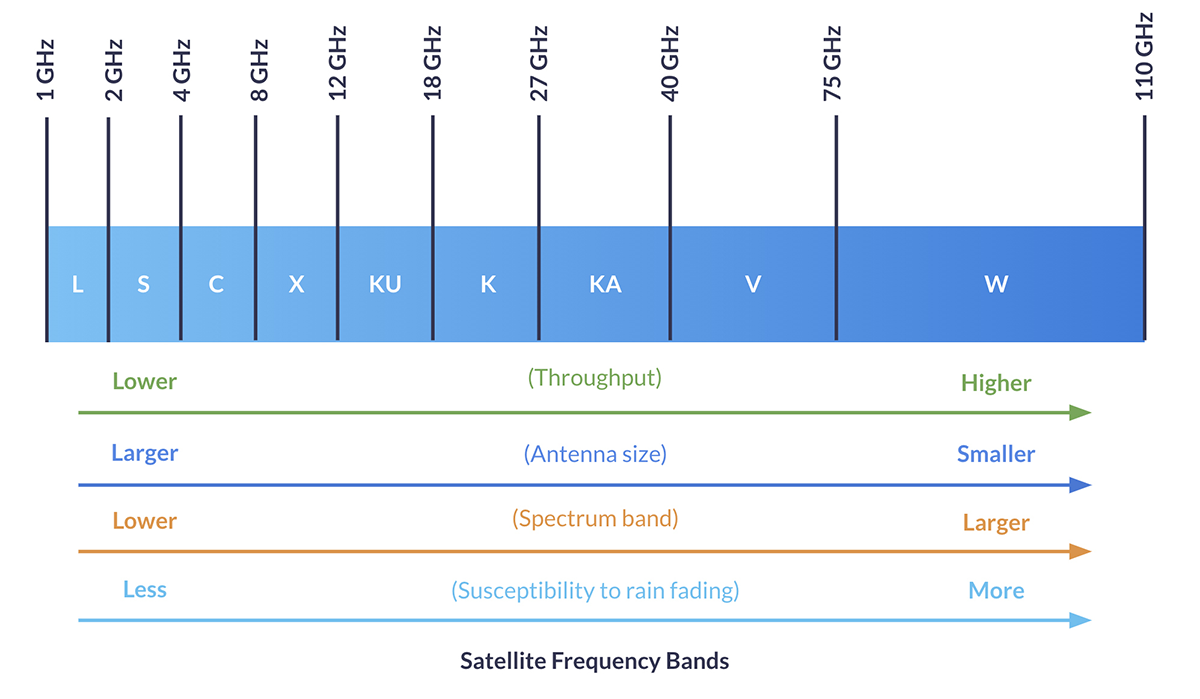

Radio Spectrum Allocation. Long-standing satellite network operators like Viasat and Iridium have licensed L-band spectrum which is ideal for IoT applications; it doesn’t require a large antenna, and is resistant to rain-fade. They can choose to allocate some of this spectrum to enable D2D.

New satellite network operators like Starlink, AST SpaceMobile and Lynk, however, need to forge partnerships with mobile network operators – T-Mobile, Verizon, Telefónica etc. – so that some of their licensed spectrum can be allocated to satellite connectivity.

This means that, for these SNOs, D2D service is only available where partnerships exist. Starlink, for example, has agreements with T-Mobile for the USA, Optus for Australia, Rogers for Canada, and several more; but is very far away from having global coverage.

There also needs to be ‘spare’ MNO spectrum available for use. In larger land masses with dispersed populations like Australia and Canada (respectively, the 6th and 9th least densely populated countries on Earth), this doesn’t present a huge issue. But consider parts of Europe or Asia; the new SNOs will have a much greater challenge gaining partnerships in densely populated countries.

Performance. As briefly mentioned earlier, the “legacy” satellite constellations of Viasat and Iridium weren’t conceived with high volumes of high speed traffic in mind. Hence the choice of NB-IoT as the networking technology, as NB-IoT’s waveform can be transmitted efficiently via satellites, with far less power required than LTE Cat 1bis – both on the device side and on the satellites themselves.

This doesn’t mean that Starlink, AST SpaceMobile etc. have a free-for-all in terms of capacity. Starlink coverage over the USA, for example, is, according to Elon Musk, anticipated to be 7 MB per beam (and the beams are very large). All users – both IoT devices and cell phone users – share that capacity, so congestion and bandwidth limitations are possibilities.

Regulatory. This is a challenge for the new satellite constellations, leveraging MNO spectrum. As Device-to-Device (D2D) communication extends beyond national borders, it poses significant challenges to existing regulatory frameworks and spectrum management practices. Since D2D users can operate in remote regions where traditional mobile networks don’t reach, their activity may span across countries. This makes it essential for neighboring nations to collaborate closely on spectrum management.

Additionally, roaming regulations, licensing, and authorizations may need to adapt, as D2D service providers are no longer confined to one country. This could lead to the development of regional or international licensing systems and potentially even an international regulatory body (source).

Funding. Companies taking the route of launching satellites compatible with terrestrial waveform technologies have a huge CapEx challenge; in order to provide service, they need to launch many satellites, at no small expense, and then bank on subscribers turning up in their tens of thousands in order to recoup their costs.

The business case for D2D purely in the context of IoT is that these new constellations will be able to communicate with unmodified cellular IoT devices – which are far lower cost than current satellite IoT devices – thus unlocking a new, lower price point for hardware. But lower costs means more subscribers need to be found before the SNO is profitable.

Existing satellite IoT applications are often mission-critical and need sureties of data delivery and speeds that D2D may not be able to deliver; thus D2D isn’t likely to dramatically cannibalize the existing satellite IoT market. New use cases need to be found, and use cases with thousands, if not tens of thousands, of endpoints.

This is a bit of a gamble when almost all of the costs have to be incurred before service can be delivered. It is possible that some of the new entrants will run out of steam before their services are commercially available.

When Will Direct-to-Device Services Be Available?

In the context of cellphones, D2D is already available, through Globalstar’s partnership with Apple. In this case, the manufacturer modified the cellphone to talk to Globalstar’s satellite network. However, this proprietary approach has proven unpopular; Iridium and Qualcomm took a similar proposition to market and ultimately shelved the project.

In terms of a standards-based D2D service, there are some early solutions being tested as we write (in September 2024). Notably Skylo, leveraging Viasat and Ligado’s satellite constellations, have partnered with several device manufacturers to develop chipsets that can be added to terrestrial devices to deliver D2D functionality.

Taking the opposite approach – with satellites built for D2D, and needing no changes to devices – Starlink have announced that they intend to offer IoT services at some point in 2025. These will be limited to the areas where Starlink has an MNO partner.

With several technical hurdles still to overcome, it’s our view that we’ll start to see larger deployments of D2D IoT devices no earlier than 2026. In the meantime, however, the buzz around lower hardware pricing is already starting to impact proprietary solutions, with Iridium and Viasat for the first time allowing mass chipset manufacturers to build hybrid devices with their modems. These economies of scale should see proprietary satellite IoT hardware reducing in price, unlocking new applications for satellite IoT long before standards-based D2D becomes a reality.

Additional sources:

Can we help?

It’s an exciting time to be working on a remote IoT or tracking application, but with the greater volume of choice comes more uncertainty about the right service provider and networking technology for you.

We can help. We work with multiple satellite network operators with both standards-based and proprietary technology, and will provide you with unbiased, expert advice.

Complete the form or email hello@groundcontrol.com and we’ll get back to you within one working day.