Even in the age of eSIM technology, there remain challenges in tracking road, rail and ocean freight across borders. This post focuses on a key challenge: connectivity. Less than 40 percent of the Earth’s land surface is covered by mobile networks. This figure drops to just 12 percent when oceans are taken into account. So, assets moving out of cellular coverage have had two options: accept gaps in tracking, or utilize satellite connectivity.

The former isn’t an appealing option; freight is vulnerable to theft, adverse weather conditions, damaged infrastructure (roads, bridges etc.), breakdowns etc., all of which can be mitigated, or at least dealt with rapidly, if real-time, global monitoring is available.

The latter – satellite connectivity – has been a mainstay of high value freight for many years, but the relatively high cost of satellite tracking devices, plus airtime, has meant that some organizations with extensive asset inventories or limited budgets haven’t been able to take advantage of the technology.

3GPP standards are poised to lower the cost barrier to satellite connectivity, both directly and indirectly, unlocking truly global asset tracking capabilities to the benefit of logistics, agriculture, manufacturing, healthcare, and many other industries.

3GPP’s Impact on Connectivity

3GPP is an initiative to create global standards for telecommunications, ensuring that a device developed and operated in North America would be able to connect to networks in Asia, Europe, Africa etc. As the name suggests, its original mission was to develop specifications for 3G mobile phones, but it has since created the specifications for 4G and 5G, with 6G in development.

Each revised version of the standards has a release number, and Release 17 was the first to accommodate non-terrestrial networks, or NTN. It was completed quite recently – Q3 2022 – and it will take time before devices utilizing this standard start hitting the market in volume.

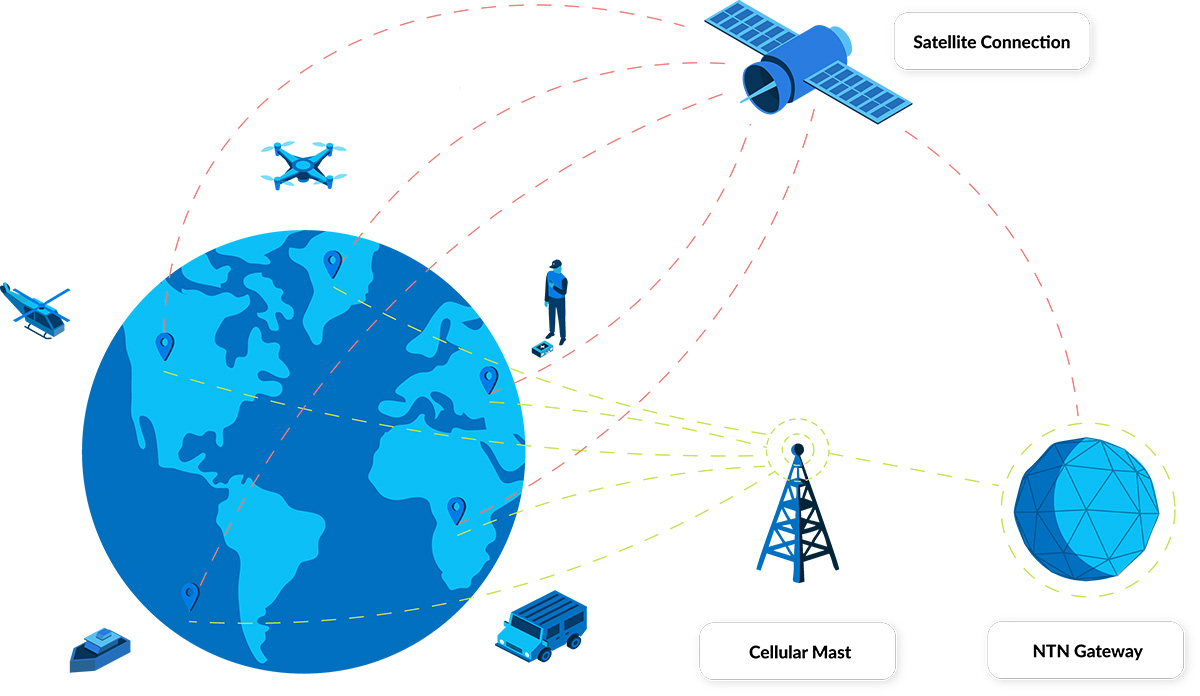

What this means in this context is that a tracking device could use a single SIM to talk to both terrestrial and satellite constellations. There are several benefits from this:

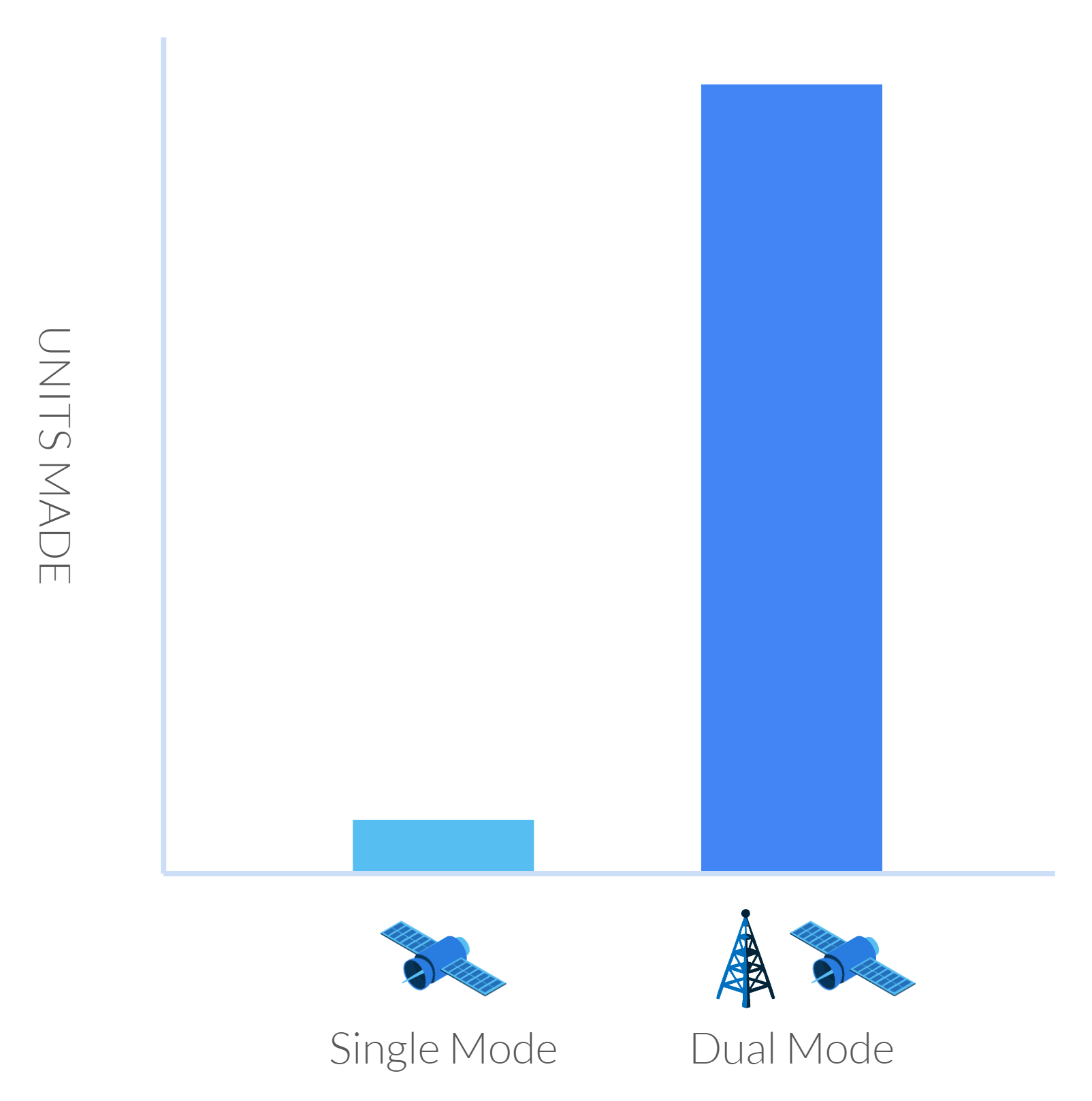

- There are millions more ‘terrestrial’ tracking devices than there are satellite-enabled ones, and because of these economies of scale, they’re generally much lower cost. If these devices are made with the ability to connect to both terrestrial and non-terrestrial networks, these same economies of scale will persist, and the cost of a satellite-enabled tracker will be lower.

- Satellite networks haven’t really, until the advent of 3GPP, had to compete with one another, in the respect that if you want to use satellite connectivity, you need to buy a proprietary modem that communicates with a single satellite network only. Once it’s in place, if you want to change the network, you would physically need to change the modem. But if you have a standards-based SIM, in theory, you can switch your airtime to a different satellite constellation remotely, with the likely impact being that airtime costs will be more competitively priced.

- Data analysis should be simpler; if your tracker is using the same networking language across multiple networks, for example, NB-IoT or LTE Cat-1, the ease with which you can integrate that data with your existing ERP, CRM or inventory management system is greatly enhanced.

Challenges With Implementing 3GPP

There are two ways to enable satellites to ‘speak’ the same language as terrestrial networks. The first is to modify the satellite, and the second is to modify the terrestrial device.

There is a limit to how much modification can be done to satellites that are already in orbit – some as far away as 35,786 kilometers from Earth. So the first option is currently the preserve of companies launching new satellite constellations. The key players here are Starlink, AST SpaceMobile, and Lynk. They are all in the process of launching satellites that are compatible with unmodified LTE-compatible devices. Their largest market is going to be cellphone users, but they’re all anticipating offering an IoT variation; Starlink is likely to be the first to market with this, some time in 2025.

However, they have a key challenge which restricts the global accessibility of these services; they don’t have access to the radio frequencies best suited to IoT and tracking applications. Licensed radio spectrum has been allocated for many years; for satellite network operators it’s called MSS (Mobile Satellite Service) spectrum, and for terrestrial network operators, it’s called MNO spectrum.

In the absence of licensed spectrum, the new satellite network operators have to collaborate with terrestrial network operators to use their spare spectrum. Starlink has agreements with T-Mobile to provide service to the USA, for example, whereas AST SpaceMobile has agreements with AT&T and Verizon. But if your truck or train traveled into Mexico, where Starlink does not, at the time of writing, have an MNO partner, the service would no longer be available.

Given that not all MNOs have spare spectrum – consider Europe and parts of Asia, where networks are already congested – it is unlikely that global service will be available in the next few years.

The second way to implement 3GPP is to update the terrestrial devices that talk to the satellites, and this is the preferred option of the legacy satellite network operators (SNOs). Viasat (previously Inmarsat) and Iridium are the leading SNOs exploring this; they have the advantage of having licensed spectrum, so their services will be globally available from launch.

But, and there’s a big ‘but’ here, they are looking at NB-IoT as their networking language rather than LTE, most probably because it is better suited to existing satellites which weren’t designed for high volumes of high bandwidth traffic. There are far fewer IoT and tracking devices that utilize NB-IoT than there are LTE-enabled devices, so it will take time for the device manufacturers to catch up.

Further, because not all of the satellite network operators have adopted the same networking language, a future in which you can negotiate on price with your SNO because there are several competitors vying for your business is further away.

However, having options to patch the gaps in cellular coverage, particularly as operators are turning off 2G, is a clear positive. If your device has a limited power source – solar or battery – LTE Cat-1 may well not be suitable. So a global in-fill of NTN NB-IoT – which is ideal for low power devices – overcomes the challenge of restricted roaming, and patchy terrestrial LTE-M and NB-IoT.

Where Does Direct-to-Device Come Into Play?

This is sometimes confused / used interchangeably with 3GPP standards-based communication, but it’s not the same thing. D2D refers to the ability for an unmodified terrestrial device to speak to a satellite, but it doesn’t have to be communicating using a standards-based language like LTE or NB-IoT.

The most well-known example of a non-standards-based D2D solution is Globalstar’s collaboration with Apple; Apple updated its handsets to speak to the Globalstar constellation, but they can’t ‘roam’ on to other satellite networks; it’s a proprietary, rather than a standards-based, solution.

Speaking of Proprietary Solutions…

It’s important to stress that proprietary-enabled tracking devices – such as those that use Iridium, Viasat or Globalstar for connectivity – are far from ‘over’. For a start, they already use the most efficient means of communication with satellites, because the devices were designed in conjunction with the satellites. They can send more data, and offer greater flexibility in terms of how that data is transmitted (i.e. IP-based, messages etc.), than standards-based propositions.

Because the narrative around 3GPP standards is chiefly around lower costs, this has already had an impact on satellite connectivity. For the first time, SNOs are enabling their proprietary modems to be incorporated into mass-produced chipsets. This will, through simple economies of scale, lead to a lower price for proprietary modems, making this an increasingly viable option for tracking trucks, trains, ships etc.

As an example, the incredibly small and light, solar-powered and satellite-enabled GSatSolar asset tracking device retails at just $199, with airtime costing <$5 per month (depending on the number of locations you want transmitting).

What Should You Consider for Your Asset Tracking Application?

Firstly, while standards-based devices promise much in the way of cost-savings and ease of implementation, it will be several years before this promise is realized. Mass deployment of devices and adequate supplier competition to influence airtime pricing is unlikely to happen before 2026-27. Further, it’s not clear how the new satellite constellations will overcome their spectrum challenges; although, where there’s a will, there’s usually a way!

In the short to medium-term, the good news is that existing proprietary satellite tracking solutions have, and continue to, come down in price. Our recommendation is to place inquiries and find out what the art of the possible is for your application.

Can we help you with your asset tracking project?

As a company that’s designed and built asset tracking solutions for over 20 years, Ground Control is well placed to help you navigate the dizzying array of options; get in touch – we’re here to help.

Complete the form, or email hello@groundcontrol.com, and we’ll come back to you within one working day.