Offshore wind farms represent the frontier of clean energy, located far from shore where the winds are strongest and most consistent. However, these remote locations present significant challenges for connectivity.

While wired connections to wind farms are frequently in place, integrating a wireless system alongside an existing wired connection for wind farms offers significant benefits, including easier sensor deployment, cost savings, and faster data acquisition.

Indeed, according to Turbit, a dedicated wireless SCADA network enhances data resilience, security, and transmission speed, allowing near real-time updates that can boost output by up to 5%.

Wireless Networking Options for Offshore Wind Farms

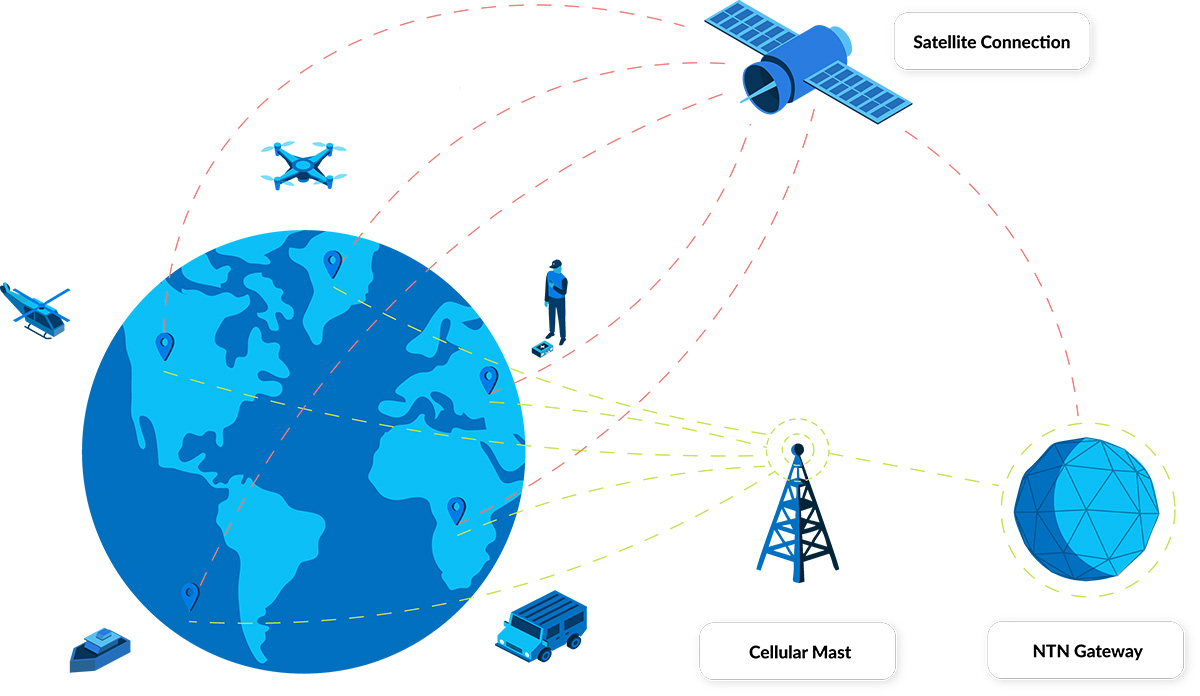

Adding a wireless network, though, isn’t always straightforward. If your wind farm is within 12 nautical miles of the mainland, you can use appropriately secured 4G/LTE. Over 12 miles, and you’re looking at either a private cellular network, or a satellite-enabled Low Power Wide Area Network (LPWAN).

Private cellular networks, although very cost-effective once set up, are expensive and time-consuming to get started with. A more agile option is to explore LPWAN technologies, and this is where the advent of standards-based networks has the potential to unlock new applications.

To start with, the current options for setting up an LPWAN for your offshore wind farm (this also applies to the Offshore Support Vessels, USVs and buoys that support your operation) are:

1. Use an LPWAN such as LoRa to locally network your sensors, aggregate the data in a gateway, then use a satellite IoT transceiver to transmit the aggregated data.

Pros of a LoRa-Based LPWAN

- No cellular connectivity is required for a LoRa network

- Most turbines don’t need a dedicated transceiver to communicate with the satellite network; only the turbine hosting the gateway needs this. This reduces the hardware costs

- Moving data within a LoRaWAN is very low cost

- Either the gateway or the transceiver should have edge computing capabilities, so that the aggregated data can be processed, and only the necessary information transmitted. This ensures that costs are minimized.

Cons of a LoRa-Based LPWAN

- The data rate for LoRaWAN is limited to 50 Kbps, which may constrain applications

- If you have the option of using a commercial operated LoRaWAN, it’s more expensive to transmit data than if you set up a private LoRa network

- Setting up a private LoRa network is resource-hungry: you’ll need to purchase the gateway(s) and a network server, write the firmware, and create the connections.

2. Individually connect your sensors to a satellite IoT transceiver to form a satellite LPWAN.

Pros of a Satellite-Based LPWAN

- No cellular infrastructure is required for satellite IoT connectivity

- There’s no limitation in the distance between your sensors; your OSVs, USVs and data buoys can all be connected, even if they’re many miles apart

- There is no impact on the reliability of transmissions in extreme weather conditions

- It’s very secure: data is hard to intercept while in space, and firewalls, VPNs and private lines protect your data once it’s earth-bound again

- Depending on your choice of transceiver, data rates can be as high as 464 Kbps

- It’s fast and easy to get started with – satellite modems can communicate with most programming languages.

Cons of a Satellite-Based LPWAN

- Cost. Both the transceivers and the airtime are higher cost than purchasing LoRa transceiver radio modules, and using a LoRa network.

So, network engineers have a choice: commit the time, effort and money to build a LoRa network paired with a single satellite IoT transceiver, and enjoy long-term low costs. Or, accept that the operating expenditure will be higher, and move more quickly with a satellite LPWAN.

What we tend to find is that the selection depends on the number of sensors: if there are relatively few, engineers like the speed, ease and flexibility of a satellite LPWAN. If there are many, the long-term cost-saving benefits of a LoRa network coupled with a satellite transceiver win out.

But what if the cost of each satellite IoT transceiver was lower? This would mean that more sensors could be individually paired with a transceiver, while costs remained within budget.

Lower module costs is one of the benefits expected to materialize from 3GPP standards-based technology, so let’s get into it.

What is 3GPP?

3GPP (3rd Generation Partnership Project) is a global collaboration aimed at standardizing telecommunications infrastructure. Established in 1998, it ensures that developers worldwide follow a unified approach in cellular technology development. One of its key achievements, “Release 17” in 2021, introduced satellite connectivity into the mix.

If a satellite network complies with 3GPP standards, a device – which could be a cellphone or an IoT device – equipped with a compatible 3GPP modem can seamlessly switch from cell tower coverage to satellite connectivity without any service interruption or the need for additional hardware. This is usually referred to as direct to cell (in the context of cellphones), or direct to device (in the context of everything else).

How Will 3GPP Standards-Based Technology Impact IoT Connectivity?

1. Lower Cost of Modems

There are millions more cellular-based IoT connections than there are satellite connections. So if you only need to buy one modem to communicate with your device, many more dual-function modems will be manufactured than satellite-only modems. Customers should, therefore, benefit from economies of scale, and a lower cost modem.

An important adjacent effect of 3GPP here is that incumbent satellite network operations like Iridium and Viasat have begun enabling chip manufacturers to incorporate their proprietary standards into mass production chips. That means that the cost of proprietary satellite modems is coming down too, again because of economies of scale.

2. Supplier Switching

Today’s satellite-only modems each talk to a specific satellite network. The ST6100, for example, talks to Viasat’s geostationary satellites. RockBLOCK 9603 communicates with the Iridium Low Earth Orbit satellite constellation. GSatSolar talks to the Globalstar network. If you want to change your satellite network, you’ll need a new modem – these are proprietary systems.

Conversely, the 3GPP standards-based modems will, in principle, talk to any satellite network that’s 3GPP-compatible. Meaning you could switch your airtime supplier without needing to replace any hardware. This may have the effect of making airtime rates more predictable, as competition to retain customers’ business will force greater pricing transparency.

Which Satellite Networks Will Support 3GPP Standards-Based Modules?

In this context, it’s helpful to structure the satellite network operators (SNOs) into three ‘classes’:

1. Established SNOs, which include Viasat and Iridium.

These operators have an advantage in that they have licensed radio spectrum in the L-Band frequency (perfect for IoT data transmissions), and global landing rights. This means their services are very widely available, and are extremely reliable, as their bandwidth is not heavily contested.

However, they need to retro-fit their satellites to support this new technology, and that’s not trivial. Viasat, via their partnership with Skylo, can connect with NB-IoT modems in North America and Europe, but have work to do to make their services more widely available. Iridium are working towards a release date of 2027 (anticipated to also be NB-IoT compatible).

2. Well-funded new constellations; chief among them Starlink.

Starlink’s best-known service is, of course, broadband internet for residential purposes. The satellites that serve these requirements are not the same as the satellites Starlink has launched since January 2024 to serve direct to cell.

The new Starlink direct to cell satellites are compatible with LTE devices back on Earth – specifically CAT-1, CAT-1 Bis, and CAT-4 modems – and service is expected at some point in 2025. Starlink does, however, have a challenge that the longer-established satellite network operators don’t have; it doesn’t have licensed radio spectrum. So Starlink partners with mobile network operators like T-Mobile in the USA and Optus in Australia to lease some of their licensed radio spectrum. Service is restricted to where these partnerships exist.

3. Innovative start-ups like Sateliot and OQ Technologies.

These companies were founded to capitalize on standards-based technology, and their satellites have been designed for this purpose. Currently, these start-ups are limited by the number of satellites they have in orbit; according to NewSpace Index, Sateliot have five, and OQ have 10 in Low Earth Orbit. This means that your sensor will need to wait for a satellite to pass overhead, perhaps once or twice a day, before it can send its data.

It’s early days, however, and both are planning to launch more satellites over the coming years. In the meantime, they are inviting people to join their early adopters program, and building partnerships with mobile network operators in much the same vein as Starlink; to leverage their licensed spectrum in areas not served by terrestrial infrastructure.

When Will Standards-Based Modems be Available?

Non-Terrestrial Network (NTN) NB-IoT modems are available now, but with limitations on coverage and bandwidth. The full promise of these advancements will be realized when there are multiple global providers, but there are issues to work out – for example, the power drain on a satellite that previously had 50,000 devices talking to it at any given time, now needing to move the data for 10, even 100 times, the number of devices.

There’s also the need for partnerships between the new satellite network and terrestrial network operators to establish global coverage – so we estimate that 2027 onwards is when we’ll see widespread adoption.

That said, as mentioned above, we’re already experiencing some of the benefits of this innovation, in that SNOs like Iridium and Viasat are set to both adopt the standards but more importantly enable their proprietary modems to be made by mass chip manufacturers, enabling price reductions from their scale.

So the shift, in some respects, is already here; you can more economically connect individual sensors using proprietary systems. As airtime and device pricing for standards-based modems becomes clearer in the coming years, you’ll have to make a choice about the best technology for your project; but the impact of standards on affordability is being felt today.

What are the Advantages of Proprietary Systems?

Proprietary systems – e.g. where an Iridium modem talks to an Iridium satellite only – are likely to remain, as they will retain advantages over standards-based systems.

“From a technical perspective, there is no definitive conclusion as to which protocol strategy is better – using proprietary systems, 3GPP standards, or other standards-based systems such as LoRa. All have their advantages and disadvantages.” – Analysys Mason

The main advantages of a proprietary system are capacity and reliability. As any cell phone user knows, when there’s a lot of traffic in the system, cell phone service slows down or even stops. Managing substantial additional demand through a finite number of solar-powered satellites is likely to present similar challenges. Conversely, licensed waveforms will not be overwhelmed by traffic, which means that when you need complete confidence that your data will be transmitted, in as close to real-time as possible, they’ll remain the preferred choice.

For Offshore Wind companies, and indeed in most cases, some data are more critical than others. You need to know if a turbine has developed a fault in real-time; but you may be able to wait a few hours to find out what your data buoys are reporting in the respect of location, wave height, temperature, salinity etc. You need to be able to communicate in real-time with a UAV / unmanned vessel, but you can probably cope with receiving data from your vibration sensors a couple of times a day.

How to Choose the Best Satellite IoT Network

This is where a trusted IoT connectivity partner comes in. Companies like Ground Control, who work with multiple satellite network operators and networking protocols, can help you choose the most appropriate solution based on data rates, criticality, security, device mobility, and location.

We are on the beta test programs for several standards-based modems, and we’re constantly exploring new partnerships from both standards-based and proprietary system providers. We test every modem in-house so we can provide our customers with objective, expert advice.

Satellite IoT is exploding with new choices; it’s our role to simplify those choices so that you benefit from the most cost-effective, easy to implement and reliable connectivity for your application.

Get in Touch

We don’t operate a satellite network ourselves, but we do design, build and test satellite IoT hardware and supporting software solutions. This gives us an expert and objective view on the best networks and networking technology for your application.

Email us at hello@groundcontrol.com or complete the form, and we’ll be in touch within one working day.